One of the most effective ways to expand your courier business is by acquiring new delivery routes. That might mean buying a route outright, forming regional partnerships, or taking over deliveries through subcontracting or contract wins.

Whatever the method, the goal is the same: to grow your coverage area, customer base, and delivery capacity without having to build everything from scratch.

Buying an existing route means you’re stepping into a working system, with customers, schedules, and revenue already in place. It’s a smart way to skip the start-up grind and is a common model for established courier companies looking to scale.

This is precisely what FedEx Ground does.

The mammoth courier company operates through independent contractors rather than employees. These contractors purchase routes (or territories) and run them as their own small business under the FedEx brand.

There are thousands of routes bought and sold every year in that ecosystem.

But if you don’t want to passively work under the umbrella of another, bigger courier, there are other ways to acquire routes that give you complete, sole ownership of them.

You can also subcontract, form partnerships with local couriers to absorb overflow, and bid for new contracts.

Each approach has its trade-offs. Buying routes can feel more complex upfront, but it often gives you the most control (and the fastest return) if you do it right.

This guide focuses on buying routes as a growth strategy, with practical steps on how to find, evaluate, and integrate them into your existing operations.

Why buying delivery routes is a smart way to scale

Buying delivery routes is a quick and relatively straightforward way to expand your operations without having to bid for new contracts (although you’ll probably want to do that in tandem).

As well as expanding your geographic coverage without having to start from scratch, you can also inherit pre-existing client relationships that have been built and nurtured over many months or years. In some cases, you’ll also acquire drivers who know the routes inside out, which can be a huge benefit for route efficiency and the customer experience.

But one of the biggest pros of buying delivery routes is you get revenue from day one. A purchased route should deliver income as soon as you take over if it’s been performing well.

What you’re actually buying when you “buy a delivery route”

The “assets” you buy when purchasing a route vary depending on the deal, the company you’re buying from, and general circumstances. But, typically, you’re buying one or more of the following:

- Geographic coverage of a specific area and the associated stop volume.

- An existing customer list or active client contracts.

- One or more drivers already assigned to the route.

- Vehicles (sometimes branded, sometimes leased or owned).

- Operational “know-how”, like informal processes, route notes, or long-standing driver-customer dynamics.

As you can see, a few of these are “intangible” assets, but they can be incredibly beneficial to a growing courier company.

The operational know-how part might seem secondary, but having drivers who are familiar with the route and its quirks, as well as having built relationships with customers on that route can be a huge bonus for trust, customer satisfaction, and overall route efficiency.

When should you buy a delivery route?

Buying routes is most realistic in situations where the routes are independently operated (e.g. franchises, contractors, small businesses, etc). You can’t buy routes from major carriers like UPS if you’re an independent owner as they only use employee drivers or central assignments. While these types of routes can’t be “bought”, there are plenty of other frameworks in which you can purchase and acquire delivery routes, it’s usually just a case of figuring out when.

Firstly, if you’re regularly turning down jobs or your delivery windows are getting too tight to maintain service quality, you could look at expanding your collection of routes.

While hiring a handful more drivers might seem like a comfortable middle-ground, bringing on whole new routes that already have assigned drivers can be a quicker, easier way to grow.

Then there’s the time factor.

Building a new route from scratch takes time, which can be a hindrance if you want to enter a new area. Buying an existing route gives you an instant foothold in a potentially under served area.

There’s another reason courier companies buy routes: to exit. It might sound counterproductive, but making sure your business is as profitable and as strong as possible before a sale will give you a better chance at a) actually selling it, b) making a decent return, and c) attracting interested investors.

How to find new delivery routes to buy

Delivery routes change hands more often than people realize, especially in busy regions where demand is high and operators are looking to scale, downsize, or exit.

Here are a few key places you can find routes for sale.

Retiring or exiting owners

Owner-operators nearing retirement are some of the most common route sellers. Many have run their businesses for years (sometimes decades) and are ready to cash out. These routes are often stable, with regular customers, and may come with experienced drivers.

Owners looking to rebalance or relocate

Route owners will regularly rejig their strategy. A courier might sell a set of rural routes to focus on high-density urban areas, or offload coverage in one region to free up capital to expand somewhere else.

This is a common occurrence in contractor-based systems like FedEx Ground and can be a good way to secure coverage in a new area.

Overwhelmed operators

Some routes come on the market because the current owner is struggling to keep up.

These aren’t necessarily “dying” routes. In fact, there’s often an opportunity to turn them around if you have the right systems in place. Most of the time, these underperforming routes have a good package volume, but simply need to be optimized or tweaked in some way.

Delivery service partners (DSPs)

In certain subcontractor ecosystems (Amazon’s DSP model comes to mind), routes are sometimes sold by companies operating under tight delivery contracts. When these contracts aren’t performing as they should or they change in some way, the company may look to exit or sell specific coverage zones.

There’s a challenge to watch out for with this kind of route, though.

They often come with operational constraints, like branding, equipment requirements, or software systems dictated by the parent company. But, if you’re experienced and can be flexible, this can give you instant access to existing profitable routes and packages.

Route brokers and franchise resellers

It’s quite common in the US to buy and sell routes through dedicated route brokers or marketplaces. These brokers specialize in matching buyers and sellers.

There can be a good amount of potential deals on these platforms, but they also vary in quality. Not all listings are well-vetted and the financials might be incomplete or overly optimistic. It’s worth a look, but do your own due diligence before signing anything.

Here are some popular platforms for buying delivery routes in the US:

Non-courier businesses with route operations

In some cases, routes are sold by companies that aren’t in the courier industry, like product distributors.

For example, Pepperidge Farm in the bakery/snack industry sells protected delivery routes to independent distributors who can deliver its products to retailers in a set area. You’ll usually get a set territory with this kind of acquisition, but you’ll also get a recurring customer base and predictable delivery schedules.

If we’re being pedantic, these are really considered distribution routes rather than your typical parcel courier routes, but they show that buying routes isn’t just limited to existing courier companies. They offer an alternative way to get your hands on an existing book of customers and pre-established sales.

Can you buy routes directly from retailers?

As a general rule, large retailers don’t “sell” their delivery routes outright. Instead, they tend to outsource them via contracts. Retailers that run an in-house delivery fleet usually partner with a courier service or 3PL rather than selling the route.

They might sell off delivery vans or refer their customer base, but it’s not a formal “route for sale” transaction in the way we’re talking about here. That said, the end result is often the same or similar: the courier takes over the last-mile routes the retailer used to handle.

How to evaluate a route opportunity

Once you’ve found a potential route, it’s time to evaluate whether it’s worth the investment.

Here’s what to look out for (note that these tips also apply to other route acquisition models, like subcontracting and partnerships).

How profitable is the route, really?

How much revenue a route makes is important, but it’s only one part of the equation. What really matters is how efficiently the route turns that revenue into profit.

A dense urban route with 80 stops across five zip codes can perform better than a rural one with 120 stops spread across 50 miles purely because it takes less time, fuel, and wear and tear on the vehicle.

When evaluating a route, check for these things:

- How many stops are there per day, on average?

- What’s the delivery density (are stops clustered or spread out)?

- Are the top clients high-volume or small drop-offs?

- Are fuel and driver hours proportionate to the revenue?

It’s worth asking for delivery logs going back at least 3-6 months to see if revenue is consistent. If you notice it fluctuates heavily, you might be looking at one of several issues, including client churn or poor forecasting.

A look at the route listings on a site like BizBuySell shows prices ranging from $95,000 to upward of $1.8 million.

Be aware of routes that are selling for significantly less than average.

These “bargains” may not be great earners, for example, because they cover a large surface area without having a lot of population density (meaning you have to cover more ground while making fewer stops).

Are the stops worth your time?

The number of stops mean nothing if a route is plagued by incorrect addresses or regular time-wasting drop-offs.

Before you sign on the dotted line, check that the addresses you’re inheriting are accurate and up-to-date, that delivery points are easy to access, and that there aren’t any problem zones with frequent failed deliveries.

How stable are the client relationships?

A route may well include existing clients, but whether they stay depends on how you handle the handover. A large portion of courier-client relationships are informal. Many aren’t locked into contracts and some might not even know their route is being sold until the new owner shows up. It’s obviously a big risk, so check in advance whether everything is legit.

You might want to evaluate things like:

- Whether there are written service agreements or handshake deals.

- What kind of expectations exist around delivery windows, proof of delivery, or specific handling requirements.

- How concentrated the revenue is (e.g. do one or two clients make up most of it?).

- Whether the seller has introduced you to the clients.

Is the driver part of the deal?

The current driver often knows the route better than anyone and losing them can upset what was a profitable, efficient route.

Check whether the driver is staying on and, if they are, under what terms.

Also determine whether they are full-time, freelance, or self-employed, and whether they enjoy the role or are ready to leave.

Will the route plug into your existing workflow?

Ideally, you don’t want to overhaul your entire operational system when you acquire a new route. It should slip seamlessly into your existing operations without too much hassle.

Find out whether the route can be mapped easily into your route planning software, whether delivery windows and volumes are compatible with your current fleet’s capacity, and whether the pickup/drop-off cadence is manageable alongside your existing routes.

Double check whether the clients need tracking, ETAs, and proof of delivery in a format you can provide.

Tips for a smooth route takeover

Once the paperwork is signed, it’s time to bring your new route into the fold. That means integrating it with your existing workflows and systems, and making sure it’s performing as best as it can be.

Keep clients in the loop from day one

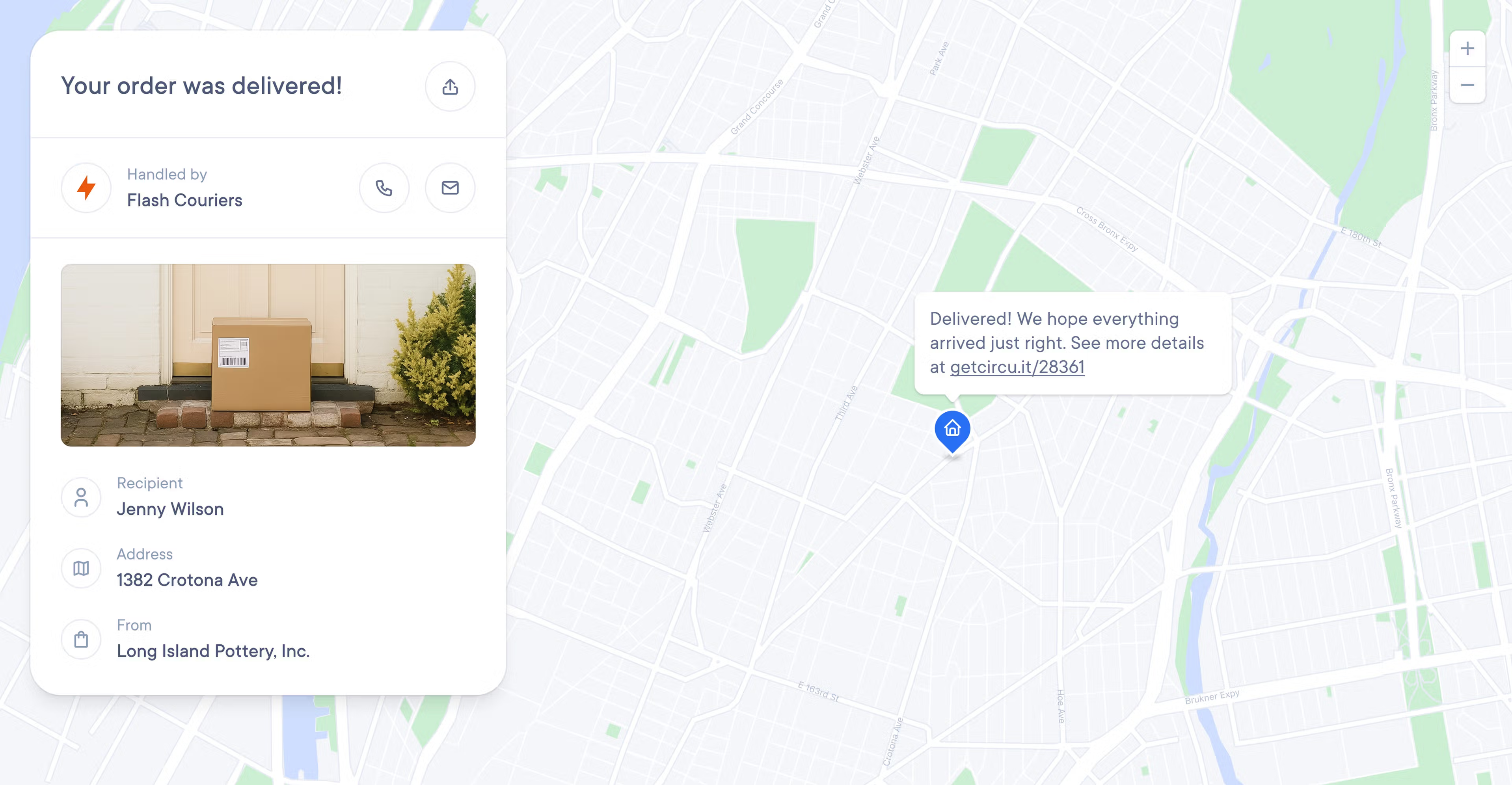

Customers rarely care who owns the route. What they do care about is whether their deliveries are on time and handled professionally.

Instead of quietly stepping into your new role and hoping things carry on as normal, consider being proactive and ease concerns early on. This might involve introducing yourself, acknowledging the change and reassuring clients their service will continue uninterrupted, or explaining any updates to tracking or delivery schedules.

You might also want to assign a dedicated point of contact for the transition period, particularly if your new clients are B2B companies with SLAs.

Preserve driver knowledge

We’ve already mentioned how crucial a knowledgeable driver is on a freshly acquired route. They know the terrain, the quirks, and the customers. Keeping them on board (even if it’s just temporarily) can make the changeover much smoother.

If you can, meet with the driver(s) in advance and, if you feel inclined, offer a retention bonus or short-term contract if long-term employment isn’t an option. Regardless of whether they stay or go, you should document route-specific insights, like preferred drop-off times, gate codes, and special instructions, for anyone who takes over the route in future.

Audit the route and optimize early

Yes, you’ve (hopefully) inherited a fully functioning route that’s been operating for a decent amount of time, but that doesn’t mean there isn’t room for improvement.

Things can always be better, especially if you’ve bought what might be considered a “dying route”.

Once you’ve gone through the handover, audit things like:

- Stop sequencing. Is the current route plan the most efficient path?

- Delivery density. Are some stops inefficient outliers? Can they be reassigned or renegotiated?

- Address accuracy. Clear up any errors, outdated info, or recurring failed delivery points.

- Client behavior patterns. Are there regular service gaps you can route around?

Align your systems and processes

Once you’ve acquired a new route, you need to bake it into your existing workflows and systems.

Running different routes on different systems and tools can really impact the customer experience and makes it much harder to create the most efficient routes possible because you don’t have all the insights in one place.

Firstly, import new route data into your existing platform.

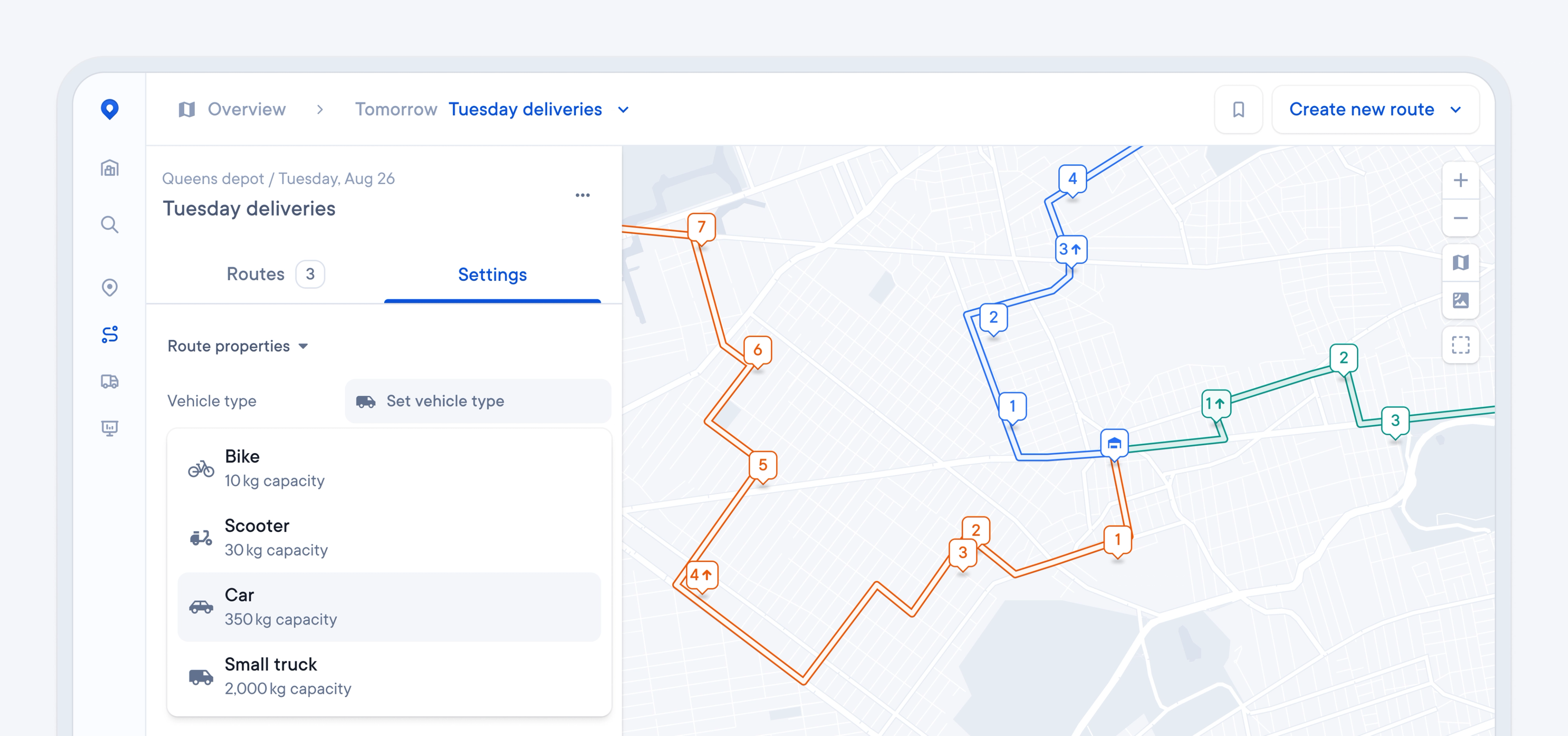

Tools like Spoke Dispatch make this far easier than it used to be, because you can streamline repetitive, potentially tedious tasks, like bulk uploading stops and optimizing individual driver schedules.

You might also want to consider equipping your drivers with the same tools, including the same tracking apps, barcode scanners, and POD systems.

Finally, at the top-level, you should standardize reporting, invoicing, and support workflows. Clients should experience exactly the same level of service regardless of which route their deliveries come through.

How Spoke Dispatch helps

The real challenge isn’t buying a delivery route (although it can be hard work trying to find the right routes), it’s integrating it into your existing systems and making sure it’s running as it should be from day one.

Spoke Dispatch helps you make the handover as smooth as possible by providing tools to:

Plan smarter, more efficient routes across your whole operation

New routes can feel clunky during the transition phase.

You might be wrangling with some overlap, inherited inefficiencies, and obviously the added complexity that comes from adding another route to your repertoire.

Spoke’s route optimization tool automatically calculates the most efficient delivery sequences based on real-world constraints, like traffic, delivery windows, and driver shift times. You can easily import stops, assign them to drivers, and adjust on the fly.

This becomes particularly important when you’re taking over a route someone else built.

You might inherit a suboptimal path, redundant stops, or outdated delivery patterns, but Spoke can help you fix those issues with ease. Simply plug in the stops and optimize in seconds, reducing any unnecessary mileage and fuel costs from day one.

Scale your courier team

You’ll be juggling more drivers after an acquisition, some of which will be operating in different areas or with different delivery styles.

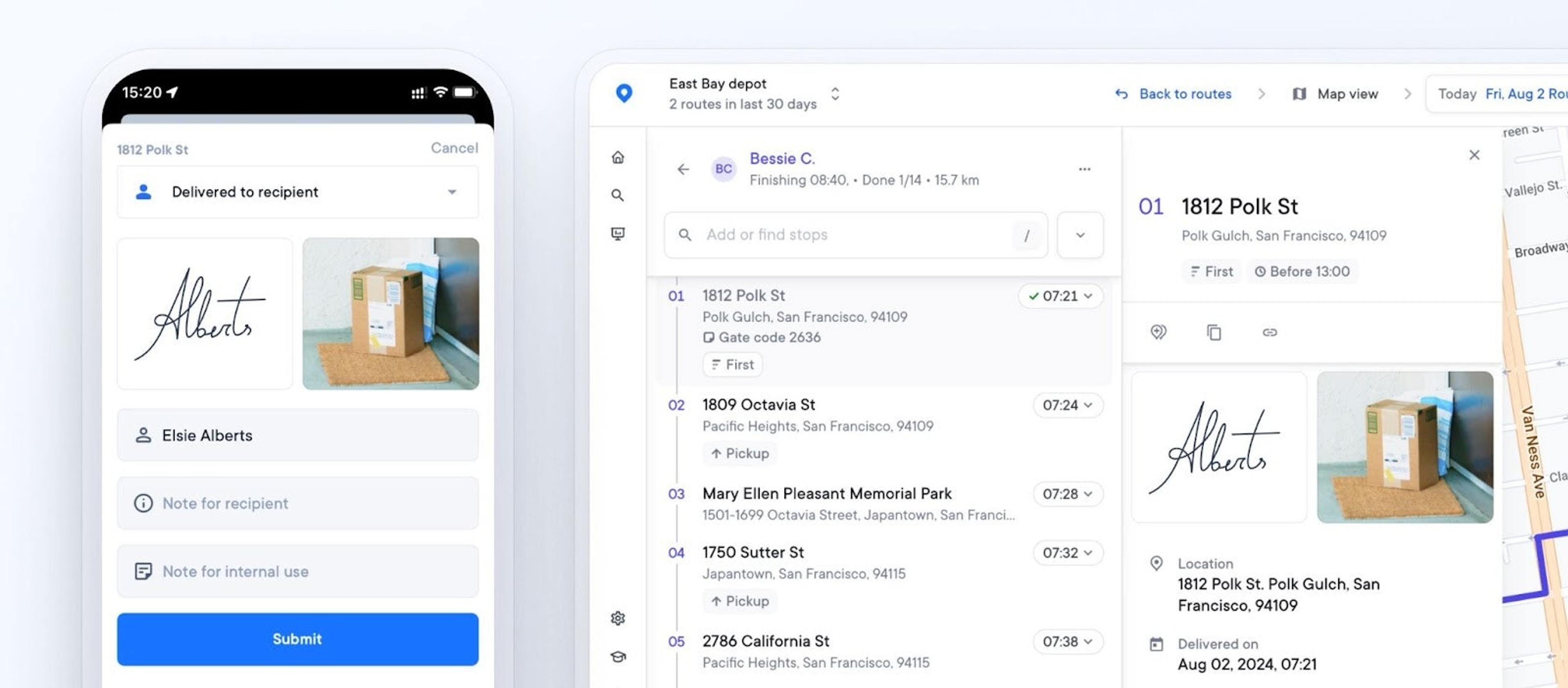

Spoke Dispatch gives you full visibility into every driver’s live location, delivery progress, and estimated arrival times.

If you’re used to managing a smaller team, Spoke makes the transition to a larger, multi-route operation more manageable.

You can manage drivers across regions in one dashboard, reassign stops as and when it’s needed, and get quick POD data from each completed drop-off.

Deliver a seamless customer experience, even during transition

Route acquisitions can feel disruptive for customers if not handled well.

Spoke Dispatch helps you keep service levels high by giving your team everything they need so deliveries are accurate and on time.

You can send automated customer notifications, offer real-time ETAs, and provide POD with photos or signatures, all without needing to adopt an entirely new tech stack.

See how easy it is to optimize new routes, manage more drivers, and keep customers happy, even during transitions. Get started today with a free 7-day trial and make your next delivery route acquisition your smoothest yet.